KIM HENG OFFSHORE & MARINE HOLDINGS LIMITED

80

Notes to the financial statements

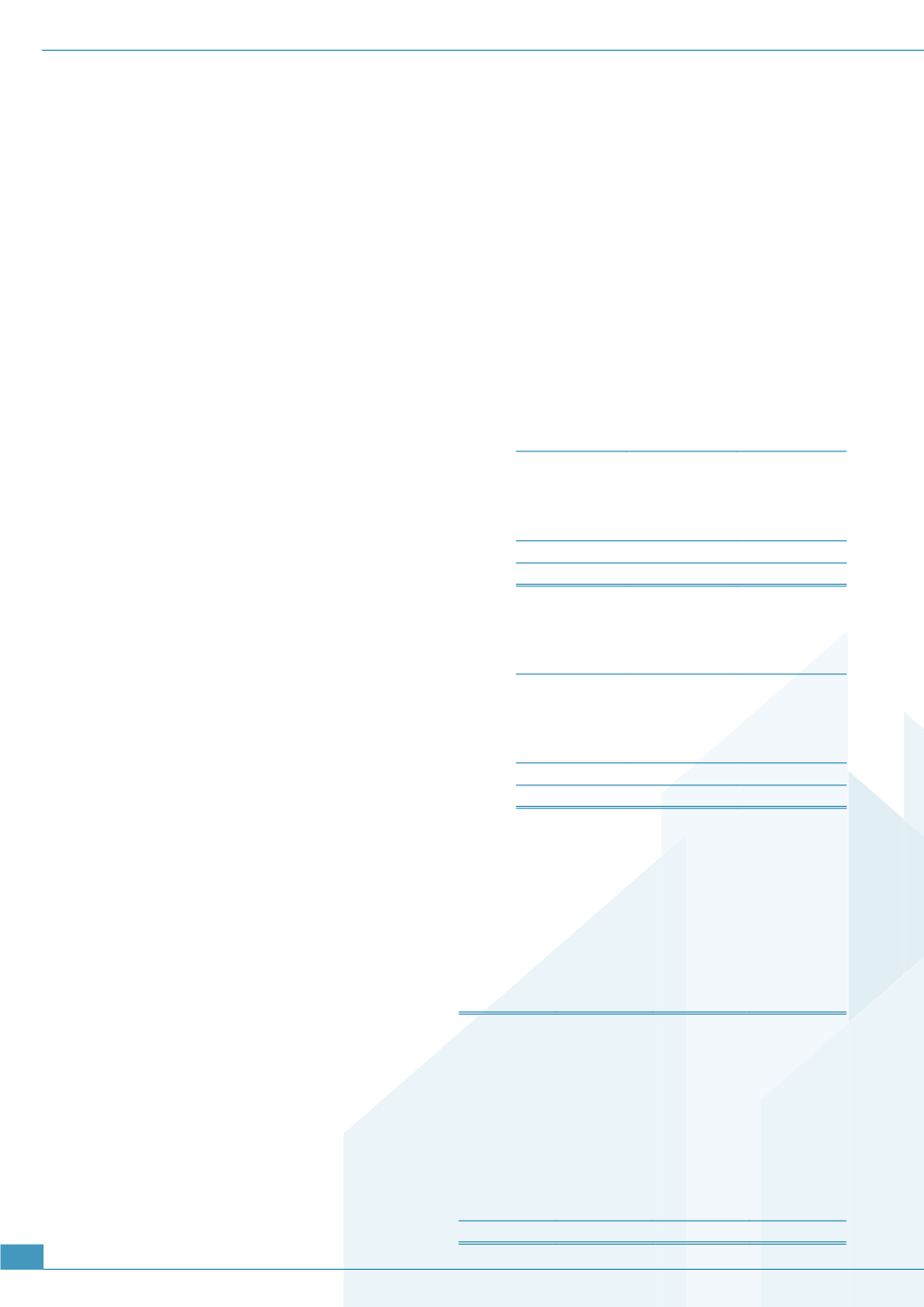

13 Deferred tax liabilities

Deferred tax assets and liabilities of the Group (prior to offsetting of balances) during the year are as follows:

At

1 January

Recognised in

profit or loss

(Note 20)

At

31 December

$’000

$’000

$’000

2015

Deferred tax liabilities

Property, plant and equipment

6,698

46

6,744

Deferred tax assets

Provisions

(78)

–

(78)

Receivables

(777)

–

(777)

(855)

–

(855)

5,843

46

5,889

2014

Deferred tax liabilities

Property, plant and equipment

6,727

(29)

6,698

Deferred tax assets

Provisions

(78)

–

(78)

Receivables

(777)

–

(777)

(855)

–

(855)

5,872

(29)

5,843

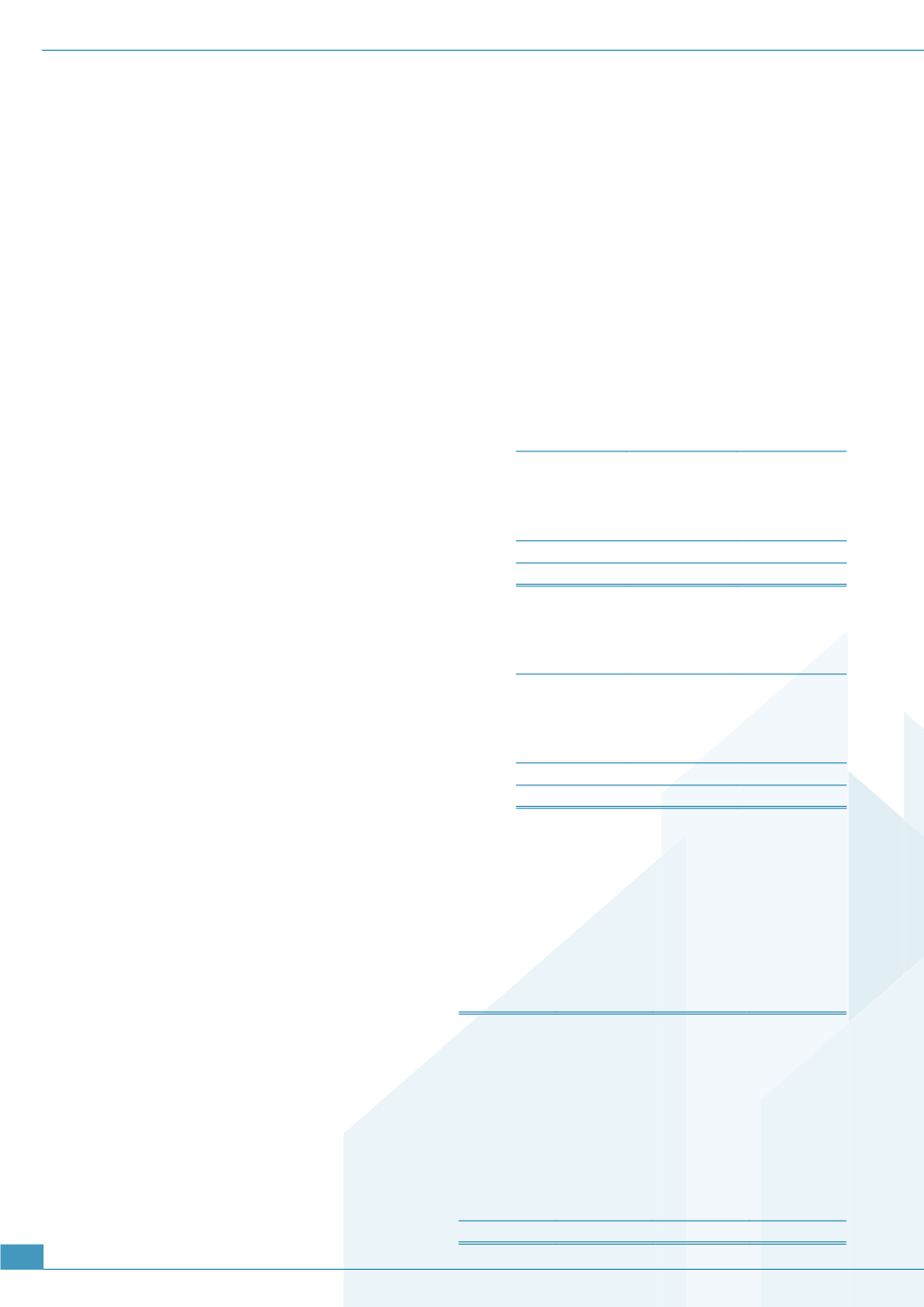

Deferred tax liabilities and assets are offset when there is a legally enforceable right to set off current tax

assets against current tax liabilities and when the deferred taxes relate to the same tax authority. The amounts

determined after appropriate offsetting are included in the statements of financial position as follows:

Group

Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Deferred tax liabilities

5,889

5,843

–

–

As at the reporting date, no deferred tax assets have been recognised in respect of the following temporary

differences:

Group

Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Unutilised tax losses

7,065

6,152

–

–

Deductible temporary differences

4,919

567

–

–

11,984

6,719

–

–