KIM HENG OFFSHORE & MARINE HOLDINGS LIMITED

84

Notes to the financial statements

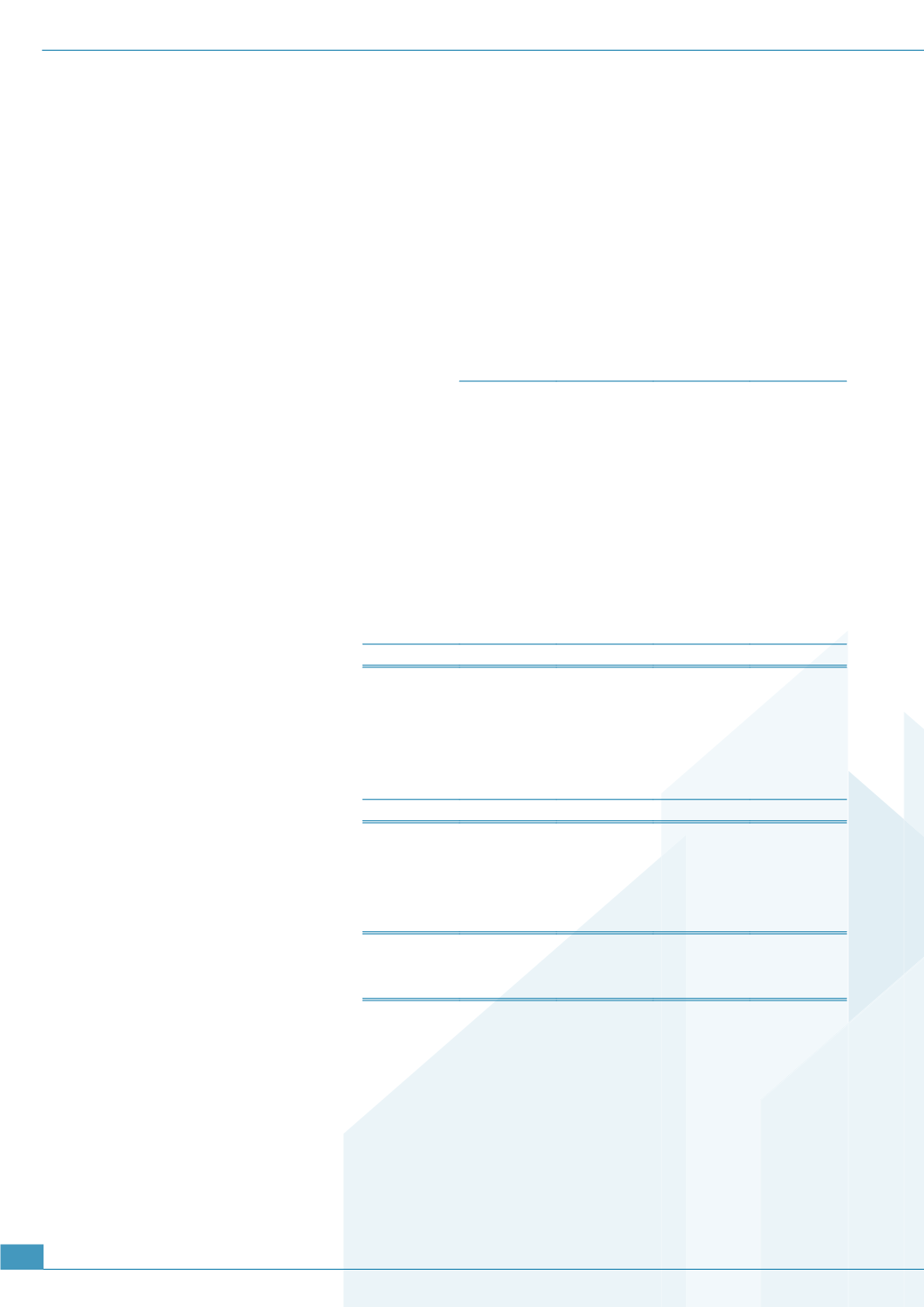

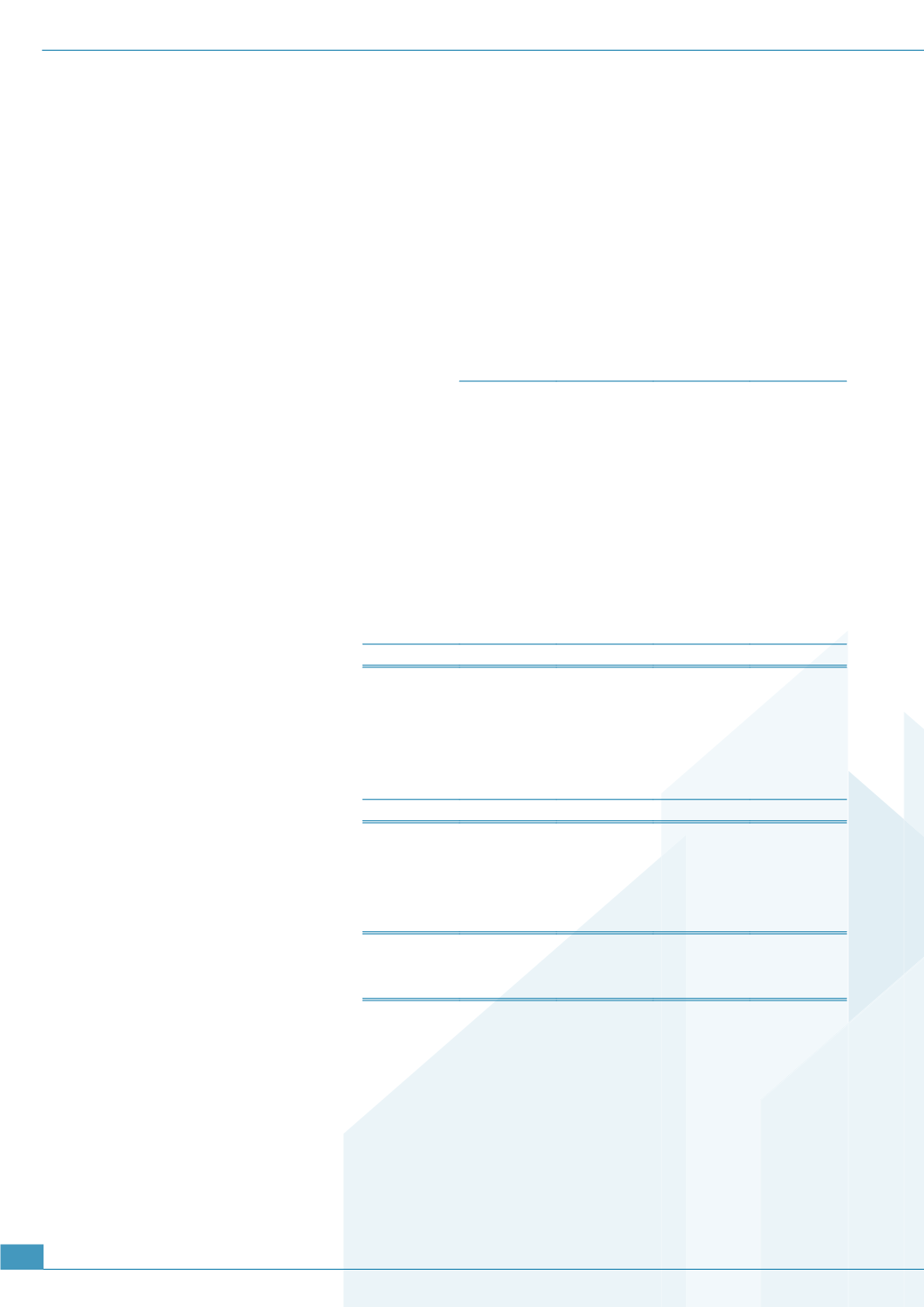

15 Financial risk management (Cont’d)

Liquidity risk (Cont’d)

The following are the contractual maturities of financial liabilities, including estimated interest payments and

excluding the impact of netting agreements or breaches of loan covenants:

Cash flows

Carrying

amount

Contractual

cash flows

Within

1 year

Within 1 to 5

years

More than

5 years

$’000

$’000

$’000

$’000

$’000

Group

2015

Term loans

- Fixed rate

3,530

(3,741)

(1,288)

(2,453)

–

- Floating rate

10,094

(10,509)

(3,173)

(7,336)

–

Finance lease liabilities

10,230

(10,890)

(3,396)

(7,264)

(230)

Trade and other payables

13,284

(13,284)

(13,284)

–

–

37,138

(38,424)

(21,141)

(17,053)

(230)

2014

Term loans

- Fixed rate

2,705

(2,856)

(1,388)

(1,468)

–

- Floating rate

3,562

(3,855)

(1,182)

(2,673)

–

Finance lease liabilities

1,860

(1,982)

(963)

(1,019)

–

Trade and other payables

17,664

(17,664)

(17,664)

–

–

25,791

(26,357)

(21,197)

(5,160)

–

Company

2015

Trade and other payables

455

(455)

(455)

–

–

2014

Trade and other payables

484

(484)

(484)

–

–

Market risk

Market risk is the risk that changes in market prices, such as foreign exchange rates and interest rates will affect

the Group’s profit or loss or the value of its holdings of financial instruments. The objective of market risk

management is to manage and control market risk exposures within acceptable parameters, while optimising

the return.

The Group is exposed to currency risk and interest rate risk.